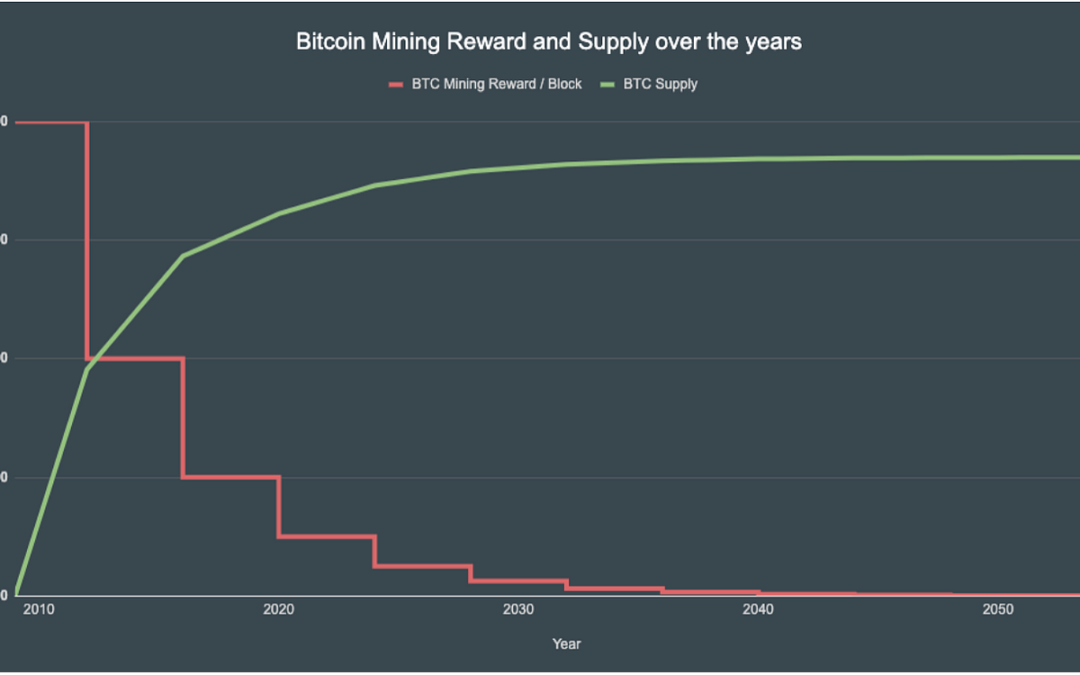

We know the total amount of Bitcoins to be issued is 21 million. The halving events address the question of when they are released.

Paragraph 6 of the Bitcoin Whitepaper sets out the idea of issuing coins as a reward for creating new blocks. The code was then developed to set out the number of Bitcoins issued for each block. See the code here. The initial number being 50 Bitcoins per block. This initial number halves every 4 years. So the first halving (to 25 BTC/block) was on 28 November 2012, the second (to 12.5 BTC/block) was on 9 July 2016 and the 3rd (to 6.25 BTC/block) is in 19 hours time.

There is a lot of analysis around the price impact of halving events, you can read some here. In my view the data is too lite (we have only two data points/events to measure) to draw any conclusions. However, in theory a reduced supply of an asset leads to an increase in price if demand stays at the same level. Also consider the reduced supply of Bitcoin against the backdrop of central bank QE and the era of QE infinity.

It is obvious to me that holding BTC will outperform holding almost any Fiat currency over the next few years. Subject of course to the usual assumptions/disclaimers and as always DYOR.