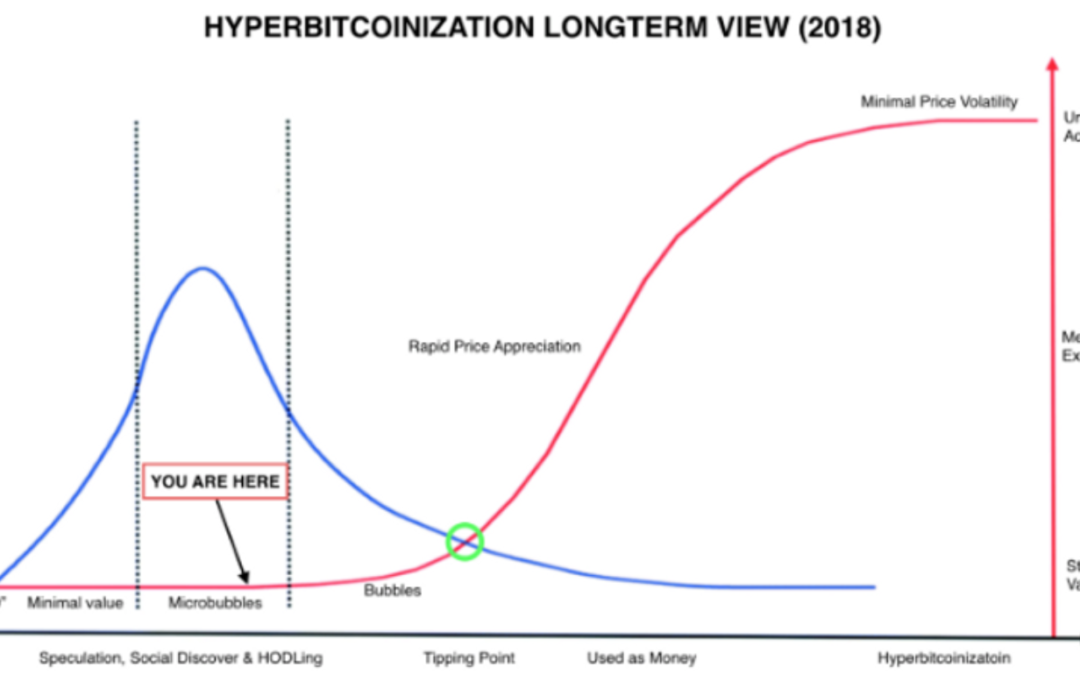

Well, it depends on your time horizon. For me, what we have experienced over the past 6-8 months in the cryptomarkets is a nano-bubble and for the moment that has burst. We are nowhere near grown-up bubble territory.

In this medium post the author walks readers through the adoption cycle of new technology and applies it specifically to Bitcoin. My view is that his theory will apply to a number of cryptocurrencies and that we will see a number of nano-bubbles before the tipping point leading to wide spread systemic institutional and government adoption (which is still years away from where we are now).

I also have a theory that the very last adopters of cryptocurrencies will be middle to low income people in the first world, because for them central bank money is working reasonably well, whereas people in the third world know how badly things can go with a centrally controlled money supply. Also consider that high income people in the first world will adopt earlier as they have the capital to take on the higher risks of being an early adopter.