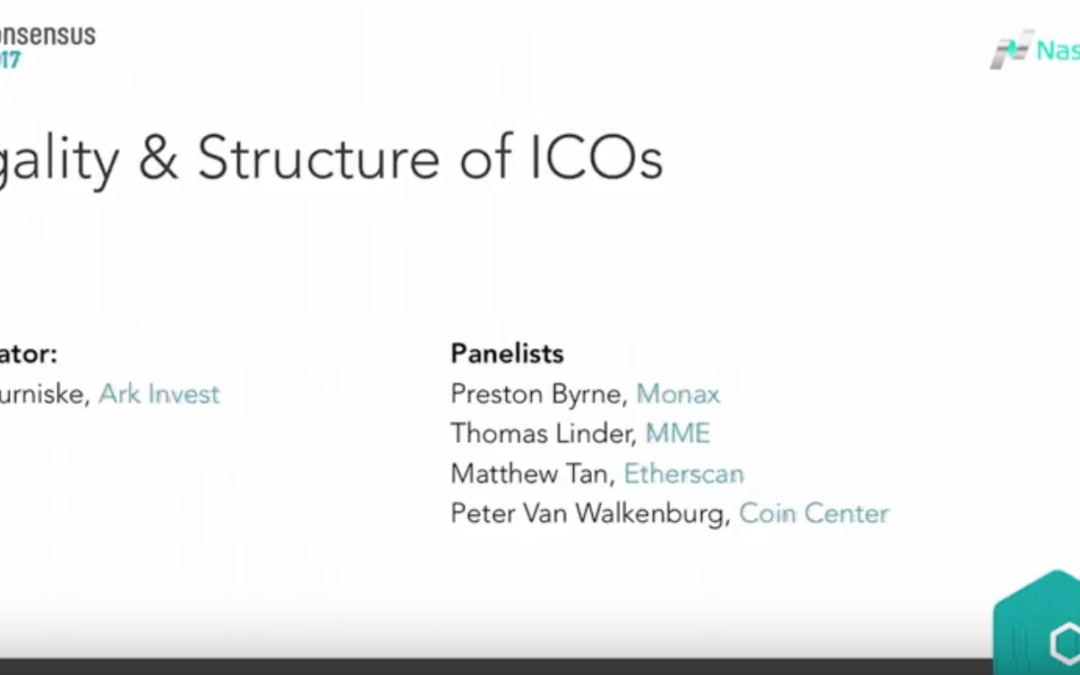

This panel discussion at Consensus left everyone none the wiser relative to that question…the room was certainly quieter as some of the froth of earlier sessions subsided.

There were strong views on both sides and of course this is a jurisdictionally specific question. The Swiss seem to have a good approach but the US seem to be failing to grasp the nature of this new asset and a too heavy hand on regulatory control may kill the potential it offers (at least for the US).

As far as Australian law is concerned, read my earlier bogs on this…it is not clear but the suggestion is to be open and transparent with the regulator from the very beginning of the project and be clear about the nature of the asset you are issuing, be clear not just what it is but also what it is not….at the end of the day it comes down to the characteristics of the asset and if it does not fit existing moulds, then proceed with great caution and be open to all interested parties.