One of the many things I love about working in the blockchain/crypto space is that I am learning new things every day.

This week I have been getting my head around the Wall Street practice of rehypothecation and comingling of assets and how this may impact the value of Bitcoin (and other cryptos) and global financial markets.

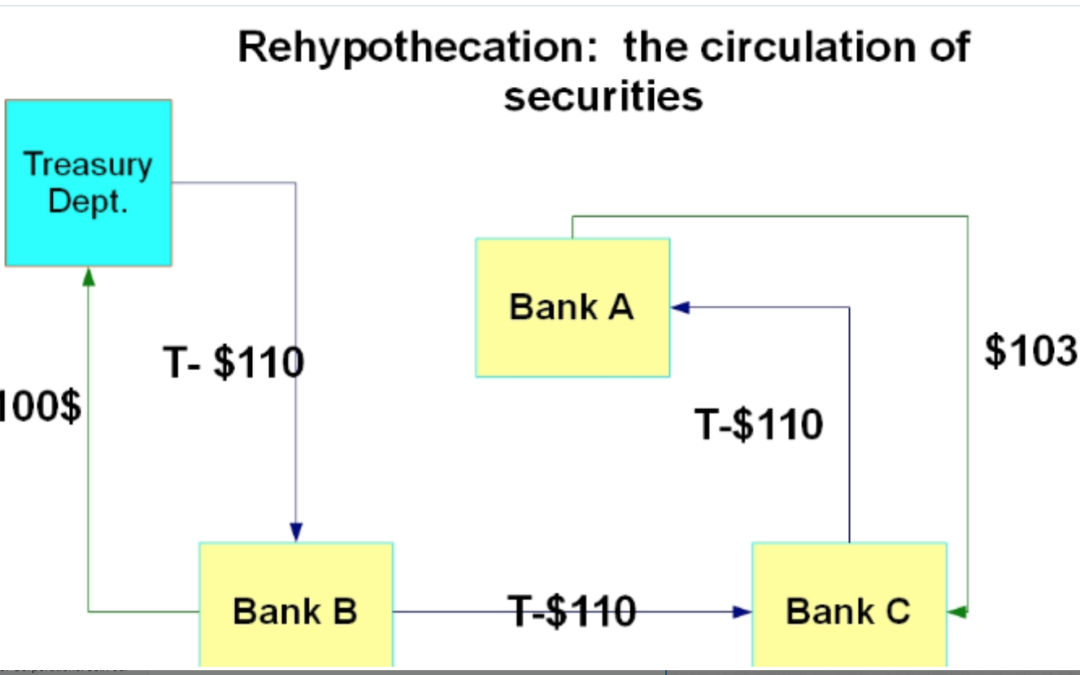

Individually these concepts are simple. Comingling of assets means putting all assets in the same bucket and rehypothecation means the same thing as remortgage but instead of referring to immovable property it refers to moveable property, like stocks and bonds.

Now, if I was to remortgage my house, the Bank would do a valuation, assess my equity and income and lend on that basis. The same thing happens in the corporate finance world, in fact it is very common widespread practice, indeed the same assets are rehypothecated many times over and the security is comingled in a security bucket. The result is that often there are more claims over assets than there are assets and it is also not entirely clear which assets secure which loans. The problem is that there is no reconciliation between claims and actual assets, this is considered by some to give rise to a significant systemic risk to the financial system.

It is these type of financial gymnastics which led to the GFC and why, for some, the idea behind Bitcoin is so attractive. Note however that ‘The “R” and “C” words, rehypothecation and commingling, are as antithetical to how Bitcoin works as they are integral to how Wall Street works.’

The concern is that if Wall Street play the type of games they are used to playing with this very different form of asset, there may be a catastrophic accident in the global financial system which gets (incorrectly) blamed, in the short term, on Bitcoin.

In the longer term, I can help but think that when the music stops and time comes for physical settlement of Bitcoin derivatives contracts that there will be a scramble to secure the physical asset (of which there is a limited number) and that the price will respond accordingly.

For more depth check this excellent Forbes article by Caitlin Long and this great podcast which goes into this in great detail.